“Denial of risk refers to cognitive ways to develop adaption to risky behaviors by rejecting the possibility of suffering any loss.” - Peretti-Watel But before we understand them, we actually need to acknowledge them.

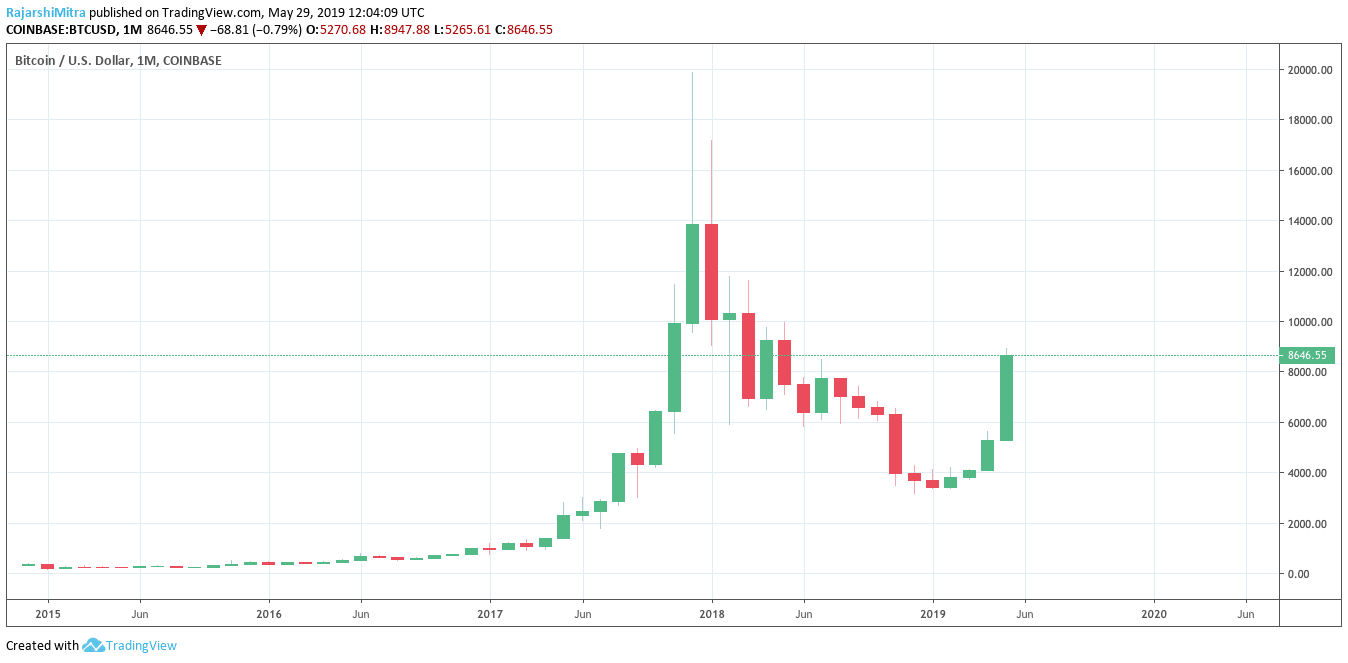

When it comes to risk management, the number-one rule is understanding your risks. Risk management from an individual perspective is the most significant assistance that each of us can offer to bitcoin in order for it to continue to grow and accept new members under lower volatility and smoother price swings. The Importance Of Risk ManagementĪll of that, as one question continues to dominate the market: How can we minimize volatility on a network that has grown from an infant into a baby, but still has a long way to go until it’s fully developed?

Bitcoin and ethereum charts series#

The ecosystem has evolved from a buyers-only market that welcomed initially long-term investors, to welcome momentum traders and speculators, proprietary desks and liquidity providers, lenders and a series of other new roles that are in fact very much needed for the long-term purpose of mass adoption, but who have brought extreme volatility in the near term as the network tries to adjust to the new, constantly-evolving reality. Players with different roles and beliefs, with the maximalists accounting now for a significantly smaller part of the pie. The answer is simple: The market participants now have different utilities and purposes than they did in the early adoption stage, and the network is having a small shock as it is trying to absorb the growth, similar to acne on a teenager’s face as their body grows into that of an adult.īitcoin with a market cap in the hundreds of billions of dollars has many new players.

0 kommentar(er)

0 kommentar(er)